MedTech after the Great Lockdown: Innovators, Investors, and 9 Trends to Consider

We presented earlier some essential orientations for MedTech organizations to adjust to the new digital paradigm, and these included 3 Major Trends the MedTech Sector Can't Ignore to Adapt its Business Models. In the third part of our discussion with Jérome Marzinski, we envision where additional investments can be instrumental to the future success of medical innovators. We then shift towards an analysis of MedTech investing in the recent months. With a description of new business trends, this episode and the next should arouse interest among venture capital, private equity, and corporate investors but also business leaders, strategists, healthcare innovators, and entrepreneurs.

4 Predictions About Medtech Innovation

Jérome Marzinski: Since many large companies have released their Q2 results (Editor's Note: the first quarterly results after the lockdown), the large decrease of elective surgeries leading to lower-than-expected revenue growth is a fact and will probably last for a while. To me, expecting a quick recovery without focusing on digital health sounds to be “Mission: Impossible.” This should spur MedTech companies to speed up their digital transformation and will allow them to address patients' needs and bring innovative solutions faster. The recovery at the hospital and doctors' practices will take even more time.

B.B.: MedTech innovation has been driven for many years by manufacturers, engineers, and scientists, bringing outstanding technologies to hospitals and patients, but also sometimes in a one-sided way, without taking patients' needs enough into consideration. Where do you position the growing influence of patient groups in the innovation and technology adoption process?

J.M.: I am a true believer in CDH-related (Consumer-Directed Healthcare) strategies, i.e., consumer-focused healthcare approaches in which the patient ("the care consumer") is adopting behaviors that influence their wellbeing. Digitalization in this space will play a central role in order to have these data analytics come straight directly from and to the patients. A quick recovery in the healthcare market must be digital and will engage much more the patients, for the benefit of an enhanced innovation process.

B.B.: We partnered on several occasions on projects related to R&D and product development. What is your view on collaborative innovation and co-creation methodologies applied to MedTech?

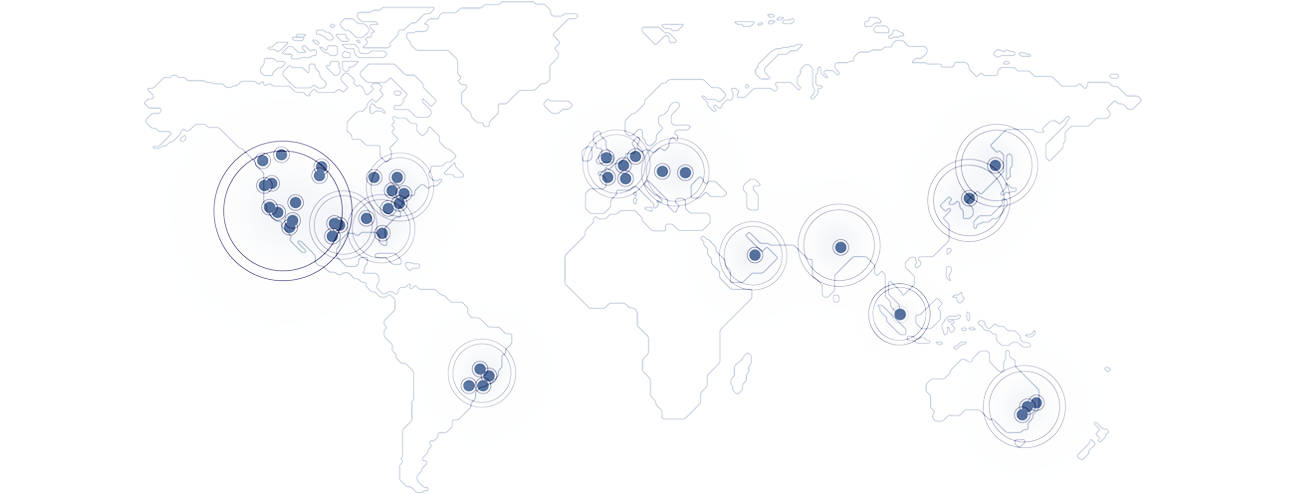

J.M.: I strongly believe that collaborative approaches and strategic partnerships are much more likely to bring innovative products successfully into the market. Most of the large MedTech firms have already developed agile and smart relationships with incubators for new product developments through startups and are getting connected to innovation clusters (in Israel or Switzerland, for instance).

B.B.: We talked a lot about the growing need for data collection, but its counterweight is data security, and broadly speaking, cybersecurity. What does that mean for MedTech companies in terms of investment towards patient data protection?

J.M.: Since MedTech companies need to focus more on data collection and analysis, data security becomes of highest importance in order to prevent cyber attacks. This is a strategic issue and one of the major threats companies will need to mitigate going forward. On personal health data management, collaboration between stakeholders in the healthcare value chain is to be clearly defined and will include insurance companies and medical devices providers to allow for patients' data safety and securely store it in the right data repositories.

"Digitalization is not only about algorithms. This is all about market and product strategies that deliver long-term value"

B.B.: Investments in HealthTech hit a record earlier this year. From your perspective, what are going to be the successful ones? And is it only about investing in software and algorithms?

J.M.: Diabetes and other chronic diseases should first take advantage of these brand new digital assets and other capabilities to enhance patients’ adoption and observance. We definitely saw a resilient growth in therapeutic areas where patients access their regular treatments outside of the hospitals, even sometimes directly ordering their devices online.

And no, digitalization is not only about algorithms. This is all about market and product strategies that deliver long-term value. This goes through innovative clinical products along with the right digital therapeutics or diagnostics component. In the end, this should really help hospitals improve medical workflows and provide solid efficiency gains.

Medtech Investing: 9 Business Trends to Consider

B.B.: I would like to discuss now the evolution of MedTech investing and how investors have acted during the pandemic. Since the J.P. Morgan Healthcare Conference last January, you have had several conversations with investors during the year. How has the investment community reacted, both in the US and Europe, especially towards early-stage companies funding?

J.M.: Let’s start with a retrospective analysis since the surge of COVID-19. Venture and private equity funds somehow stopped looking at investments right at the beginning of the virus outbreak in mid-March. Back then, the priority for most of the private equity funds was to actively and financially support portfolio companies’ working capital. At the macro-economic level, and in order to safeguard some entire parts of the economy, many countries have implemented bail-out measures to secure the liquidity of these companies (guaranteed loans, deferred tax payments, etc.).

As far as the early-stage companies funding is concerned, I believe that many venture and corporate venture funds have obviously slowed things down in the first phase (March/April/May). Their deal flow was already full enough, without any imperious need for freezing due diligence activities. Subsequently, they expect to close some deals before the end of 2020.

"A major gap in funding still exists between available and invested capital"

B.B.: And what about private equity funds?

J.M.: The situation on the capital development related to private equity funds might be slightly different. As I said, many funds had to financially support existing portfolio companies; thus, this has created some distraction on the Mergers & Acquisitions (M&A) deals front. M&A will naturally slow down as the number one priority is to manage liquidity. Restructuring debt and equity towards operating assets that will provide a much higher return on invested capital will be predominant until the end of 2020 and most likely over 2021.

As far as numbers are concerned, in France over July 2020, 12 closings were signed in healthcare and MedTech deals worth €100+ million of raised capital, including one significant transaction related to Withings amounting to €53 million.

That being said, a major gap in funding still exists for series A between available and invested capital. In order to assess how strong the venture funding market is, I am used to reviewing the invested-to-raised capital ratio. Under healthy circumstances, this ratio should be between 1.3 and 1.6. Since 2010, this same ratio reached this bar three times. I would be very curious to know how high this ratio is nowadays since the surge of the pandemic.

B.B.: With this in mind, what impact do you see on the financing of MedTech innovation and the activities of investors?

J.M.: Regarding the aftermath of COVID-19 on financing through venture or private equity funds, I see six significant elements emerging from my discussions with investors:

- A MedTech funding gap still does exist, most notably in Europe versus the US, and this entails a major imbalance between the amount of potential growth capital and the number of high quality of investment opportunities in series A financing rounds.

- Clearly, a higher selectivity from venture funds to identify and pick investment opportunities.

- The lure of excess capital available to finance true innovative medical device technologies urges new project owners to review their business plans, adjust their value proposition, and beef up their pitching decks.

- A two-fold factor still applies between the amount of Euros or USD invested into BioPharma versus MedMech. Invested capital in series A for MedTech still lags behind invested capital in Biotech.

- EV/EBITDA ratios will worsen down the road and will make exit scenarios and valuation modeling trickier to defend in front of potential strategic buyers.

- As a result, valuation of companies will naturally decrease. This will make some operating assets more attractive for potential buyouts and therefore create many M&A opportunities (e.g., following "Buy & Build'" strategies).

"True innovation in MedTech will still be funded, yet in a longer timeline and through a more rigorous due diligence process"

B.B.: In these market conditions, what are the main recommendations you would give to entrepreneurs, innovators, and project owners?

J.M.: Let's be clear: True innovation in MedTech will still be funded, yet in a longer timeline and through a more rigorous due diligence process. That means three takeaways for project owners:

- Scientists as new project owners should be more nimble, humble, and eager to start thinking from Day 0 about the go-to-market strategy. Any innovative MedTech, regardless of the level of embedded innovation, needs a proper commercial route-to-market while assessing a proof of concept.

- A “winner-takes-all” market will rule the series A funding rounds. More resilient MedTech segments, such as digital therapeutics, connected health, and other niche technologies, will dominate the funding market. These technologies will be preempted by early stage ventures, either through venture or corporate venture funds.

- While entering into term-sheet negotiations and investment agreements, new project owners should be much ready to compromise on several provisions, such as earn-out, full ratchet, and other anti-dilution rights. Term-sheet negotiations will get tougher and will also require to master negotiation skills with real-life experience.

(End of part 3; to be continued)