MedTech after the Great Lockdown: Going Digital & Evolving Business Models

In our previous interview with Jérome Marzinski, we reviewed some of the major challenges the healthcare sector is faced with in the early post-COVID world and uncovered 5 Key Takeaways for MedTech Business Leaders. In the second part of this discussion, we want to have a deeper look at how organizations will have to evolve both with the help of digital technologies and by adjusting their teams to the new conditions across all departments and functions. In these uncertain times in which resilience prevails, how can MedTech leaders adapt their business models towards sustainable growth?

Going Digital: 5 Orientations For Organizations to Adapt

Benoit Becar: COVID-19 and its consequences dramatically reduced travel activities, office presence, and access to hospitals, but also physical interactions between teams and with clients and external partners. Even most medical congresses and scientific conferences have moved to virtual meetings. What does this entail for organizations and their different departments (Sales & Marketing, R&D, Clinical Affairs, Operations)?

Jérome Marzinski: The main short-term impact of COVID-19 affects all customer-facing teams and organizations. One more time, traditional sales processes involving sales representatives “chasing the case” in the Operating Rooms (OR) will be somehow broken for a while. The magnitude of the shock has been so abrupt that most companies really understood the compelling need to embed digitalization into their strategy rather than considering digitalization as hype that may drive growth achievement.

Clinical Affairs departments will be also mostly affected. Online clinical educational courses have become the new standard while interacting with Health Care Professionals (HCP). Clinical Affairs leaders should also quickly adapt their own processes through a smart digitalization approach.

B.B.: Does that mean as well a rise in direct-to-patient models? Will these new trends affect traditional marketing and communication channels?

J.M.: As a MedTech leader, I always, way before COVID-19, developed value propositions that fulfilled patient, doctor, and payor’s benefits. I would foresee an uptake in “direct-to-patient” models for delivering healthcare in the coming months with tailor-made patient-driven educational programs. However, with that being said, the role and involvement of top-notch Key Opinion Leaders (KOLs) will remain at a high level in order to allow proper dissemination of an innovative product throughout the entire marketplace. Digitalization should definitely help gaining quicker, direct access to patients.

"Future winners in the healthcare market will focus on data rather than the product. Data is going to be the raw material of the 21st century"

B.B.: Even before the COVID-19 crisis emerged, some MedTech organizations invested in new sales channels, such as inside sales, remote selling, or enhanced account management. Cost-efficiency and limited access to hospitals combined with the need for more strategic and targeted selling – are data analytics taking over personal relationships?

J.M.: The rise of Artificial Intelligence (AI), machine and deep learning is shaping the healthcare market. Use and interpretation of smart data analytics lie in the right solution for delivering cost-effective and scalable healthcare solutions (both for products and services). The challenge lies in developing total solutions embedding AI that really hit the market demand.

Future winners in the healthcare market will now focus on “data” rather than the “product.” Data is going to be the raw material of the 21st century.

New sales force effectiveness programs and commercial strategies will need to be developed in most of the MedTech organizations, except for those which are positioned on “high-end, niche product” segments, i.e. neuro-vascular or interventional cardiology.

B.B.: Without a doubt, online distribution platforms and e-retailers are the big winners in the post-lockdown world. For the healthcare industry, how does this translate on supply chain models and the availability of medical devices through these platforms?

J.M.: COVID-19 has had a huge impact on supply chain models due to the fact that some critical healthcare products (pain killers, for instance) were not sufficiently available to meet the high level of demand. Double-sourcing of key strategic products will become the new rule for future success with an expected downside: an expected increase of the price point. In order to mitigate this increase, new Lean online distribution and shipping platforms will be established. Once again, a thorough analysis and review of the price versus value matrix will be reinforced in MedTech, no matter the size of the company. Market intelligence specialists, growth hackers, Health Technology Assessment (HTA), and value-based pricing experts will be leading marketing and commercial departments.

B.B.: Because of your earlier career in the IT/software industry, I know you have a strong interest in data analytics and in AI in particular. Can you share your views on how these technologies will impact the clinical agenda? I mean clinical education, clinical research, and eventually, patient outcomes.

J.M.: Online educational courses for teaching HCP and spreading innovation will become the new standard, and this will cause a major distraction in some of the unprepared MedTech companies as far as the digital agenda is concerned.

I have no doubt about the long-term trend, yet I do have a mixed feeling about the short-term response. Now let me elaborate a bit more on this AI topic. Is AI going to be able to correlate billions of data together? The answer is “yes.” Is AI going to provide meaningful correlation that will drive individualized patient’s response through personalized medicine? The answer becomes “not quite yet." Thus, this turns into a huge, fantastic opportunity to help shape the healthcare of our tomorrow’s world. AI, along with machine learning, should drive accuracy improvement at the diagnostic level as well as further and better promoting personalized medicine. Predictive analytics stemming from AI will also enhance the adoption of evidence-based medicine through predictions made at the individual level. AI and digital health should bring these tangible benefits:

- As already mentioned, minimizing avoidable cost of services.

- Surely improving clinical outcomes.

- Promoting patients' awareness and increased observance.

- Shifting the focus to disease prevention from disease curation, and this is going to be a long journey.

Even before the COVID-19 outbreak, I have been involved in many projects related to robotic-guided surgery and digital therapeutics in neuro-surgery, ophthalmic surgery, and orthopaedics. My take is very simple: any breakthrough innovative device that only improves clinical outcomes without reducing the cost per case/procedure will not reach high penetration rates when launched in the market. Even if this adds complexity, it creates exciting opportunities to drive efficiency, and I am sure this is going to keep me busy for a while. Based on my recent experience, only a very small number of companies with breakthrough products tick the box in this regard.

Evolving Business Models: 3 Trends Medtech Can't Ignore

B.B.: Clearly the market conditions we describe push the industry irremediably towards a generalization of value-based care approaches, which you advocate. Ignoring this trend means going for commercial failure or certain commoditization - hence the growing need for market access experts, which I have witnessed over the recent years. Does this apply to any segment in MedTech?

J.M.: Let’s define the main challenge MedTech innovators are facing: a very costly product development process that sets the bar very high in terms of proposed pricing for end users. For instance, this is true in robotic-guided surgery but also applies to limited and general surgery applications and other high-end medical devices products. In short, value-based care emphasizing on a true evidence-based medicine will become the new standard for new device launches with granted reimbursement. Many drivers (i.e., price pressure, COVID-19, CAPEX investments freezing at the public hospital level) will push this trend forward in most of the developed countries.

B.B.: What is the role of governments and notified bodies to facilitate technology adoption, beyond the additional requirements for clinical evidence and patient benefit? And what is the impact on an international development strategy for a MedTech organization?

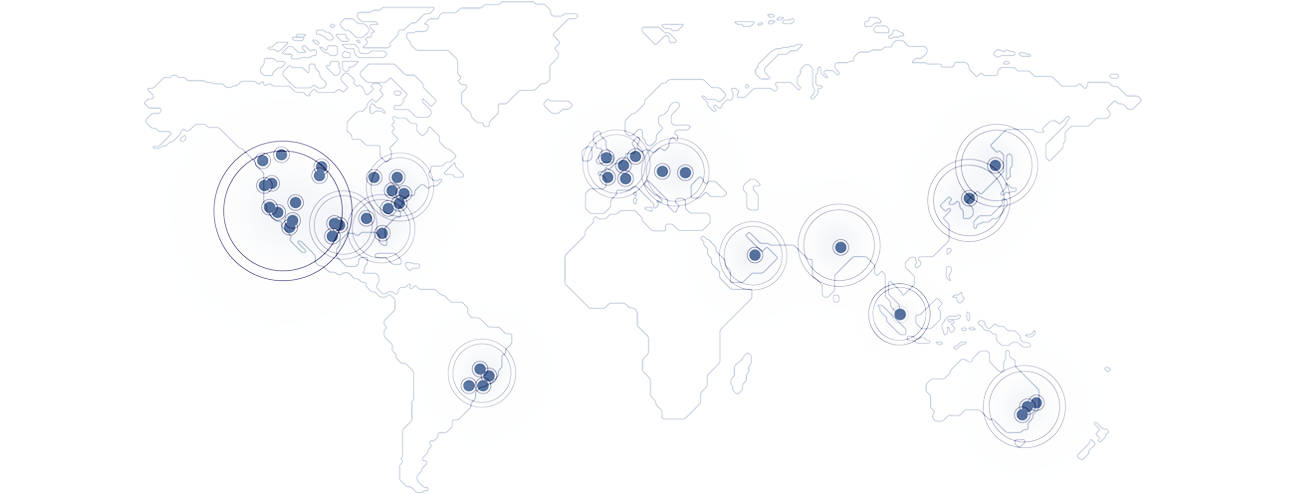

J.M.: There is no “one size fits all” answer to this question. A market-specific approach based on geographies is to be considered. As an example, the European Union (EU), which is dominated by heavy bureaucracy, still very much emphasizes the precautionary principle as far as healthcare ruling is concerned. This results in developing unsustainable quality requirements (transition from MDD to EU MDR, even though slightly postponed). Today, there are market places in which the time to market for launching a medical device is a competitive weapon (for example, South Korea, Singapore, Argentina, or Mexico). Once again, more mature markets such as EU countries can be characterized with very stringent regulations, and it may be seen at first glance as a major drawback for global companies. That said, negating the value and importance of European markets while launching a medical device that fills an unmet clinical need, just because of the regulatory burden, is a big mistake in my opinion. Europe still remains a major market, with several assets, including its large patient population with access to highest standards of care. In order to maintain its relative competitive advantage, upcoming regulations will be key.

"Solely product-focused companies will not be the long-term winners"

B.B.: In the early 2000s, you experienced several technology transitions in IT/telecom, with new business models completely transforming the sector. What can MedTech leaders learn from the emergence of licensing, subscription, or pay-per-use models that disrupted the IT industry 20 years ago?

J.M.: Late in the 1990s until 2006, I spent about 10 years in the IT market in a company (Sun Microsystems) that was acquired by Oracle Corporation in 2009. Back then, no one in the IT/software industry would have put a winning bet on the current gigantic firms that lead this market nowadays (i.e., FAANG/GAFAM companies). The reason is pretty clear: market leaders at that time were more focused on product rather than data. Google was the one that successfully developed superior solutions emphasizing data management and being able to monetize them through targeted advertising.

The aftermath is totally compelling: solely and merely product-focused companies have not been the long-term winners, and I foresee the same trend affecting the MedTech industry. Except for very specific, targeted clinical applications requiring specific implants, product-focused strategies for MedTech won’t provide any superior payoff in the market game. The right bets should be put on companies that also invest significantly in data management to sustain their competitive advantage.

As a personal example, I was leading the taskforce within Sun Microsystems that developed and successfully launched in 2002 the first “pay-per-use” licensing model for large IT CAPEX investments dedicated to telecom providers. At the time, this was seen as a revolution, and this similar trend would likely apply in the healthcare market for large CAPEX investments. Similarly, the same approach should be considered for MedTech.

(End of part 2; to be continued)