MedTech after the Great Lockdown: 5 Key Takeaways for Business Leaders

Among all the sectors I have covered in my consulting and executive search career, I have developed a true passion for the healthcare industry, and more particularly, in Medical & Health Technologies (MedTech & HealthTech). It is fascinating to work with business leaders and strategists, innovators and scientists, doctors and healthcare professionals who impact positively the daily lives of millions of patients across the world. In the recent months, I have been fortunate to connect and reconnect with many MedTech executives and hear their thoughts about the evolution of the industry. So when I suggested that Jérome Marzinski, a long-standing business partner in MedTech, share his insights in this interview, I found an excellent summary of many ideas that came through all my recent discussions. This is the first episode of a series, which I hope MedTech & HealthTech business leaders and investors, healthcare practitioners and consultants, and anyone with an interest in the future of this industry will find insightful.

Benoit Becar: Thank you, Jérome, for taking the time today to discuss and share some insights on the evolution of the MedTech sector. To get started, can I ask to briefly present yourself and your background?

Jérome Marzinski: Thanks, Benoit, for inviting me to this session. Indeed, we are seeing several accelerating trends in the Medical Technology industry in 2020. Let me introduce myself in a few words: I was a Board Member and leader of several fast-growing MedTech companies (Visiometrics, Vexim, and ev3-Covidien). I like to describe myself as a hands-on CEO, always excited to build startups from scratch through scale-up, international expansion, and turn-around.

After more than 25 years of experience (13 years in the medical devices industry and 12 years in the IT market, with Sun MicroSystems), I have worked closely with a broad network of investors (venture and private-equity funds). This includes more than €50 million of capital raised through diverse transactions (IPO, private offering) combined with more than 15 M&A completed.

4 Challenges to Address After The Great Lockdown

B.B.: The Great Lockdown and COVID-19 have had a clear impact on the digital agenda across many sectors and industries. If it was not already the case before 2020, its prioritization across all businesses is now a given. What trends do you see in the healthcare sector that trigger a faster adoption of these digital technologies?

J.M.: First, let me give you the backdrop of the overall situation affecting the broad healthcare market. Surely COVID-19 has played a kind of “catalyst role” for MedTech companies to adapt their business model, operating systems, and processes. COVID-19 and, more likely than not, future upcoming infectious outbreaks, along with other threats such as cyber-criminality, will bolster market challenges that were existing prior to the pandemic. These challenges can be summarized as follows:

1. A slower recovery of surgical activity. A broader number of people, along with the ageing of the worldwide population, needs better access to healthcare services at a lower than existing cost. In most developed countries whose healthcare infrastructures are well implemented, the predominant portion of healthcare costs occur in the last year of people’s life, or more precisely, in the last day of living.

Nevertheless, we don’t have to be fooled by this argument: An ever-expanding population does not necessary lead to an increasing market demand. In the context of the COVID-19 pandemic, market demand has been dramatically wiped out due to the cancellation of most elective surgeries during the lockdown.

Looking at the recent Q2 earnings calls from major companies, e.g., Abbott and Beckman-Coulter, which are positioned on diagnostics while providing adequate testing and diagnostics capabilities, these organisations can maintain revenue and profit growth. In contrast, other MedTech corporations have reported lower than expected financial results. Even worse, since they don’t expect a quick uptake in procedures and recovery of volume, they lowered their financial guidance for the rest of the year. That’s a fact. That said, as we notice in most of the European countries a current decrease in coronavirus cases in the hospital admission, elective surgery procedures will grow at a slower pace.

2. Cost pressure vs. access to novel technologies. In the recent years, we have seen a rising cost of delivering healthcare services combined with the current level of public healthcare spending in most of the developed countries. Always keep in mind that every year, the USA spend the equivalent of 6 iPhones 11 Max, circa $10,000 per capita, whereas in contrast the average OECD countries only spend $4,000 per person. Increased price pressure will be bolstered and will force MedTech organizations (regardless of their size) to revamp their strategy going forward. At stake, the competitive positioning of every medical technology will be challenged.

3. Healthcare IT integration still in progress. The healthcare industry has still to find a way to effectively harness the power of digital health (namely AI, Robotics, Big Data, Machine Learning) into an integrated IT platform of healthcare providers. Chronic diseases (diabetes, cardio-vascular diseases such as CAD, orthopedics, and ophthalmology surgery, with real 3D imaging and guided systems) are the first targeted segments for a quick and easy digitalization, to my knowledge and experience.

4. Skills & talent shortage. A global imbalance is growing between supply and demand of healthcare services (between developing and developed economies, in addition to a shortage of key healthcare workers in developed countries). Due to COVID-19, new challenges have emerged such as access to healthcare professionals (HCP) and the effective way to broaden access to technology and innovation through full-fledged, digitally-enabled customers solutions.

5 Key Takeaways For Medtech Business Leaders

B.B.: In this context, we saw indeed a growing pressure on business leaders, with finance controlling and business modelling teams urged into crisis management and asked for short-term solutions. For the longer term, which strategic directions should MedTech leaders be aware of and eventually be taking?

J.M.: MedTech leaders should now think in “stochastic versus deterministic” terms as far as their strategic planning is concerned. This sounds to be quite trivial, but it does stress the need for MedTech companies to wholly redesign their models. Just think about the entire time it takes to reflect on strategic planning updates in very large organizations. This does not make sense if these firms want to quickly react to big time distractions such as the COVID-19 outbreak."

"A new generation of leaders should now emerge while managing a more resilient and adaptable planning process, flawlessly and seamlessly"

The best illustration, except for companies holding high stakes with the development of vaccines against the virus, is that most other healthcare companies now play a very defensive strategy, safeguarding their own employees. They are not actively recruiting and are losing talents over the marketplace.

A new generation of leaders should now emerge while managing a more resilient and adaptable planning process, flawlessly and seamlessly. Just to illustrate this argument, a large global medical device company took more than five months to increase their production capacity of ventilators and respiratory devices to meet the increasing demand due to COVID-19. This is not what we call a very reactive response in a context of such pandemic and crisis, let alone the mask and basic medical supplies.

The bottom line is: Successful MedTech players will need to provide a holistic market response including:

1. A product development process that fulfills the value-based healthcare principle. In other words, patients' value is defined as the ratio of delivered outcome/cost for delivering this outcome. Optimization of this ratio has to be paramount. Artificial Intelligence (AI) could help to achieve a lowering of this ratio by minimizing avoidable costs of usage of healthcare services. Reimbursement authorities will predominantly assess this ratio while granting a reimbursement fee for any new medical device product.

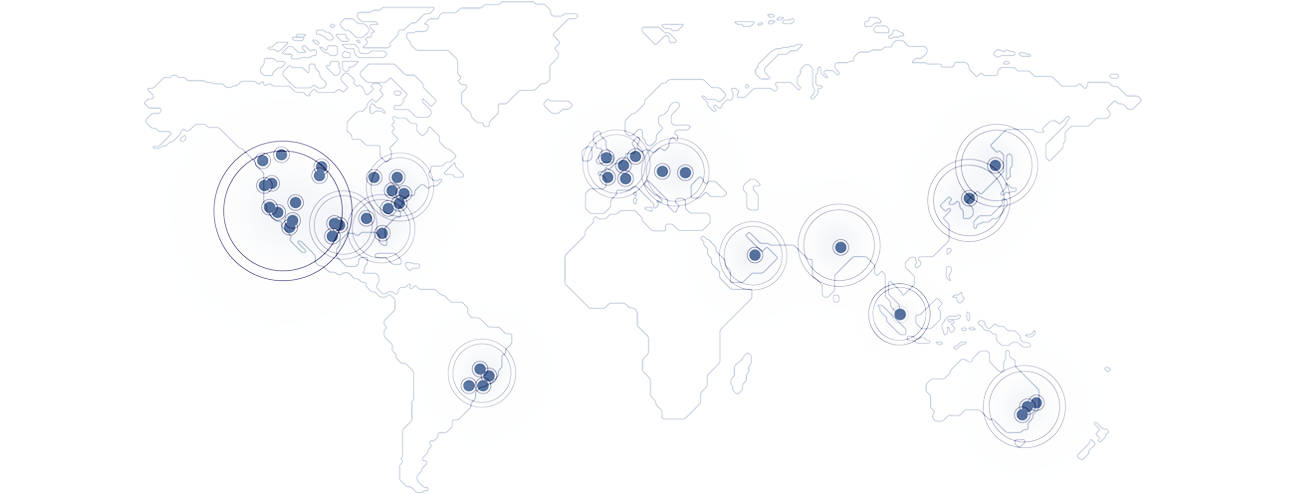

2. A right international expansion strategy and execution at best value. A true international market knowledge is deemed necessary to pick the right countries as “winning bets” in the roadmap deployment. Given my experience, only very few executives have this discriminating and specific skillset.

3. A fair pricing model that incentivizes payors and maximizes the value power of true innovative solutions. It is a direct and necessary link to the value-based healthcare principle mentioned earlier.

4. A scalable digital strategy emphasizing on patients’ satisfaction while reducing the cost of healthcare solutions.

5. Finally, an urgent need to “Think Outside the Box” in terms of talent strategy. Stop cloning your staff and allow for diversity (not only on gender) but as well as on business, market, and sector experience.

True disruptors of any industry are not “insiders” of this industry as they are not influenced by subjective bias in how they solve business problems.

(End of part 1; to be continued...)