Move Markets

ZRG transforms the recruitment experience for financial services organizations, exceeds expectations, and delivers the exceptional executive talent you need to achieve your strategic business goals.

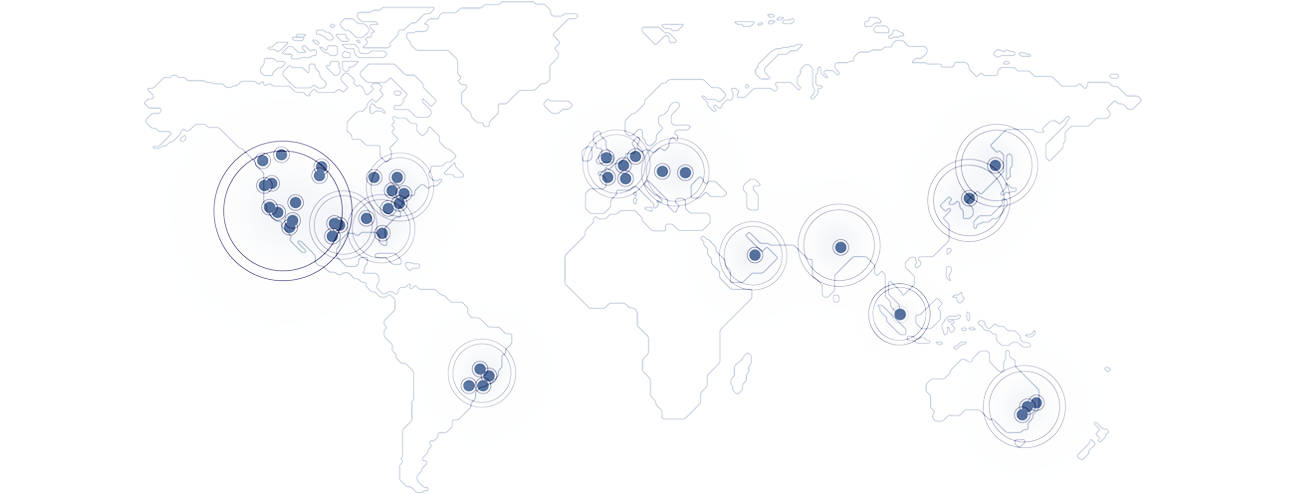

Worldwide Support, Expert Guidance

Our Global Financial Services practice is run by experienced professionals with a proven track record of achieving outstanding client results. With offices on five continents, we're here to assist you anytime, anywhere.

Talented Leaders with the Right Culture Fit

At ZRG, we understand the critical importance of finding leaders who align with your company's culture. We harness our industry insights, tap into our extensive network of top executives, and employ precise assessments to pinpoint the leaders who meet your talent needs and embody your company's values and culture.

Specialized Expertise

Our team has partnered with clients across the financial services world, including clients in the following fields:

– Banking

– Investment Banking

– Wealth Management/Private Banking

– Private Credit / Direct Lending

– Investment Management

– Payments and Lending

– Community Development Finance

– FinTech

– Digital Currency / Bitcoin

– Blockchain

– Insurance

– Real Estate

– Private Equity