Covid Ripples: Pandemic Effects in Life Sciences

8 Min. Read

To say that SARS-CoV-2 upended much of the world is simultaneously trite and a colossal understatement. A staggering percentage of the world’s workforce shifted quickly to a virtual landscape, and all employees, university students, and even elementary schools all suddenly found themselves out of the workplace and classrooms in favor of video conferencing. Through all of this, the life sciences field obliterated the record pace of vaccine development, delivering multiple vaccines built on novel platforms in a little under a year. Vaccine news has been a mainstay of press coverage throughout this crisis, but the shape of the industry that produced those vaccines—from investments to staffing trends—has been less of a journalistic focus.

Talent Crisis

The public health crisis of the past year has brought other crises to light as well. Among these is a talent crisis in the C-suite of life sciences and healthcare high tech companies. Although it has been brewing for longer, the additional investment in and attention to life sciences companies has clarified the shape of the talent crunch.

“There has been an over-investment in our industry since 2018,” according to Robin Toft, Global Life Sciences Practice Group Leader at ZRG Partners. “As a result, we had an unprecedented number of IPOs last year. The Series B size has escalated dramatically: everyone is raising $100-150MM easily,” she continued. The immediate impact of financing is scaling up and hiring volumes of people. In terms of what that means structurally for companies in the field, she offers that “they’re all going through the same situation: building the company through focus on scaling dramatically, hiring the pre-IPO team, hiring the CFO to take the company public, and in parallel re-structuring the board to prepare to meet the needs of a public company. Very few VC’s and PE firms anticipated the resulting talent crisis: many CEO’s and boards are just realizing that there are not enough people to sit in all the seats and get it all done.”

The pressure on the talent pool isn’t only from increased investment and corporate growth. New channels of talent are both being created and tapped at unprecedented rates to address telemedicine and the digitization of healthcare information, further increasing the pressure on the overall talent pool. Additionally, with a rapidly growing number of life sciences players, we have seen “a significant rise of Medical Doctor (MD) recruiting and the desire to have MDs not just in clinical and medical roles where they traditionally were employed, but across a range of functions including clinical development, market access, commercial roles, and general management roles including CEOs, particularly in early-stage companies,” per David Fortier, Global Life Sciences Practice Leader at ZRG Partners. Fortier notes “every time a company is started or funded it needs a CEO and it often needs a Chief Scientific Officer or a Chief Medical Officer. Today there are now several companies vying for each experienced candidate, and first-time leaders are becoming the new normal.”

Scientific advancement in these areas can also drive demand for specific expertise which may or may not be in sufficient supply. Fortier notes that “there’s been a lot of scientific discovery around the fact that inflammation isn’t just a symptom of a disease but may be a contributing cause of several diseases...,” to which Toft adds that “Infectious diseases as a sector was exceptionally difficult to finance for years, however in the aftermath of the pandemic, there is now high interest from top tier investors.

Not Everything Grew

While early stage and mezzanine financing certainly grew in many areas of the life sciences, some areas were flat or even declining over the past year. Funding for orphan diseases and rare diseases did decrease in this period. It may be because investors threw their weight behind COVID-related research and delivery systems. While more money flowed into the sector overall, this particular therapeutic area did not see much benefit from the increased attention that the pandemic spurred.

Investment in tools and diagnostics was also relatively flat, although anything related to COVID-19 drew both interest and investment. Machine learning, AI, and data analytics all rode the pandemic tailwinds. It is clear that the market prioritized the vaccine side of COVID research, but it remains to be seen just how much impact on tools and diagnostics will come from the increases in investment and attention.

IPO vs SPAC

As we have detailed elsewhere, the COVID pandemic corresponded to an absolute explosion in the use of SPACs—Special Purpose Acquisition Companies—to move a company into the public sector. Increased regulatory scrutiny of the SPAC process seems to be cooling this market down. SPACs offer a much faster route to public trading than IPOs, but they may ultimately be “simply another useful option for companies to meet their needs,” according to JP Morgan's Peter Meath.

This growth, however, can be deleterious to the talent pool for the C-suite. “Every time there’s an IPO, the CEOs—and particularly the experienced CFOs—are locked up for a good period of time: sometimes two to three years. Additionally, those that have been successful often choose to take time off or leave the workplace. That reduces the number of available CEOs and CFOs and has a ripple effect at all leadership levels,” says Fortier.

Supply Chain Issues

Materials and supply chain vulnerabilities also came to the forefront over the past year. Specifically in pharmaceutical production, reliance on a global economy entails accepting a global level of risk. “Currently, over 80% of pharmaceutical ingredients come from India and China, and the United States is increasingly relying on China and India for active pharmaceutical ingredients (APIs). To decrease foreign dependencies, there is a growing trend for bringing production back onshore, or reshoring." As waves of the pandemic washed over countries in turn, India having taken the most recent blast, we have seen disruptions in this supply chain. Bain and Company report that “Of the 118 FDA-reported drug shortages in August 2020, 55 were related to an increase in demand, 16 to API [active pharmaceutical ingredient] shortages, and 8 to manufacturing or shipping delays. The majority of drugs in short supply are small molecule generics.”

Going Remote

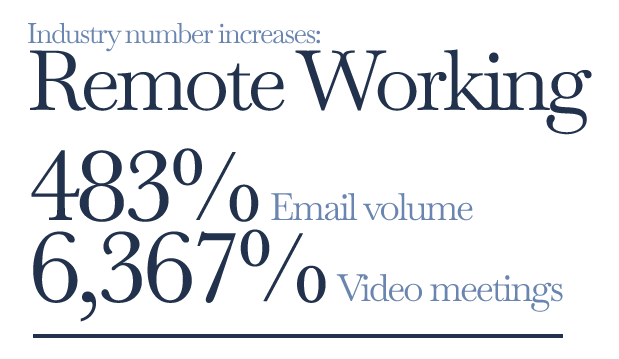

APIs and other pharmaceutical materials were not the only things that seemed remote throughout the year. Life sciences pivoted quickly and decisively to a remote footing both for work and sales. Although hospitals obviously needed to stay open for patients, sales reps were asked to work remotely. Deloitte computes the increase in emails and remote meeting usage by life sciences sales divisions between January and April of 2020 as 483% and 6,367% respectively.

“All of a sudden, the market moved to telemedicine overnight,” as Toft puts it. “All that interface with consumerization, SaaS companies, how to deliver medical data online, has become a huge demand area. So consumer-facing people who really know how to consumerize a company’s offerings are in high demand.”

Addressing the Crisis

All of this adds up, as mentioned above, to incredible pressure on the talent pool for senior life sciences leaders. Toft and Fortier both identified Chief Medical and Chief Science Officers as key positions where demand for talent outstrips supply. Any newly-founded or newly-funded startup seeking a CMO or CSO is going to face unprecedented competition for the most obviously desirable candidates.

Resolution of the crisis requires an educational component: CEOs, heads of HR, and especially venture capital partners are generally not aware of the shape and scope of this crisis, with some insisting on a business-as-usual approach in a very unusual business climate. Speaking of the pressure from venture capital partners, Toft remarks that “They’re still refraining to their CEOs ‘hire a rock star.’ Unfortunately, the rock stars are typically all employed at really good companies.” The answer, however, is not to lower the bar on the quality of candidates. “We need to change the bar to embrace future rock stars – those people who are working hard to create a name for themselves in the industry with huge ability to contribute, at the right career stage, and at the top of their game,” as she puts it.

Basic supply-and-demand forces are also in play here. “The downstream effects on some of this—when you have that much of a demand and that much of an imbalance in terms of the supply of talent—is price inflation,” Fortier reminds us. “Compensation packages are escalating dramatically. Many clients are experiencing sticker shock when they find out what it takes to compete in the market today.” He points out that it is not only demand pressure pushing compensation upwards but also location. With sizable biotech and pharma hubs in Boston, San Diego, and San Francisco—three of the persistently highest-cost cities in the United States—there is an additional upward pressure on compensation packages.

Where there is an upward pressure on compensation, there is also a downward pressure on the age and experience required to serve in leadership positions. According to Toft, the COVID crisis accelerated a mass exodus of Baby Boomer-aged talent from the market of available talent. As any demographer can attest, Generation X is substantially smaller as a generation, further reducing the supply of experienced leaders.

We are in a “candidate driven market” where candidates are in the drivers’ seat for the foreseeable future according to Toft. Creativity and dedication to building talent pipelines are both necessary for companies to continue to grow in this sector. Toft strongly believes that investing in the talent you already have by offering development programs, coaching, mentorship, and leadership training will prove to be the differentiator between companies that win and lose the war on talent in the coming years. Additionally, flexibility to location and the diversity of the organization are key drivers to attracting the best talent – companies that don’t adapt may not survive. There is an adage in real estate that says land is valuable because they’re not making any more of it. “Candidates are like San Francisco real estate,” says Toft, underscoring the pressure companies are under to address the crisis of leadership talent in life sciences.