Transitioning 2019 to 2020 in Asset and Wealth Management

We will likely look back at 2019 as marking the dawn of a new age for the asset management industry. While the shift toward passive investment (with its concomitant pressure on fees) and the rise of quantitative investment methodologies have been long coming, this past year feels like an inflection point has been reached.

Whether we’re thinking about the reality that over 75,000 financial services executives have lost their jobs in 2019 or that passively managed fund inflows outstripped actively managed funds from January through September, we are clearly in a new environment that is putting pressure on financial services organizations of all stripes to evolve.

For traditional, active managers, the impact of these trends has been obvious and sharp: with fees pressured, there has been an inevitable “rationalization” of workforce size, bonuses, and even office space. However, at a deeper level, this dynamic is forcing a rethinking of how active managers create value for customers—putting an even greater emphasis on relationship management skills (and not just relationships) on the business development side while requiring investment managers to build a new degree of comfort with quantitative methods and tools as man-and-machine meet.

For passive managers, the data science imperative only increases and the “race to zero” continues. That is, whether it’s been trading commissions or fund management fees, the zero-bound seemingly has exerted a gravitational pull that is driving us to new levels of efficiency that might have been nearly unthinkable five years prior. Thus, continue to expect extreme competition for two types of professionals: 1) those with the ability to push the limits of quantitative approaches to asset selection and portfolio creation and 2) those who can develop and maintain the infrastructure required to create highly efficient and agile systems that can race the next innovative product to market.

However you look at it, we are in an environment that continues to evolve rapidly. So, while many will focus on the differences between the past and present, the better way is to see the opportunity in this change — if leadership at firms attract and hire the right talent.

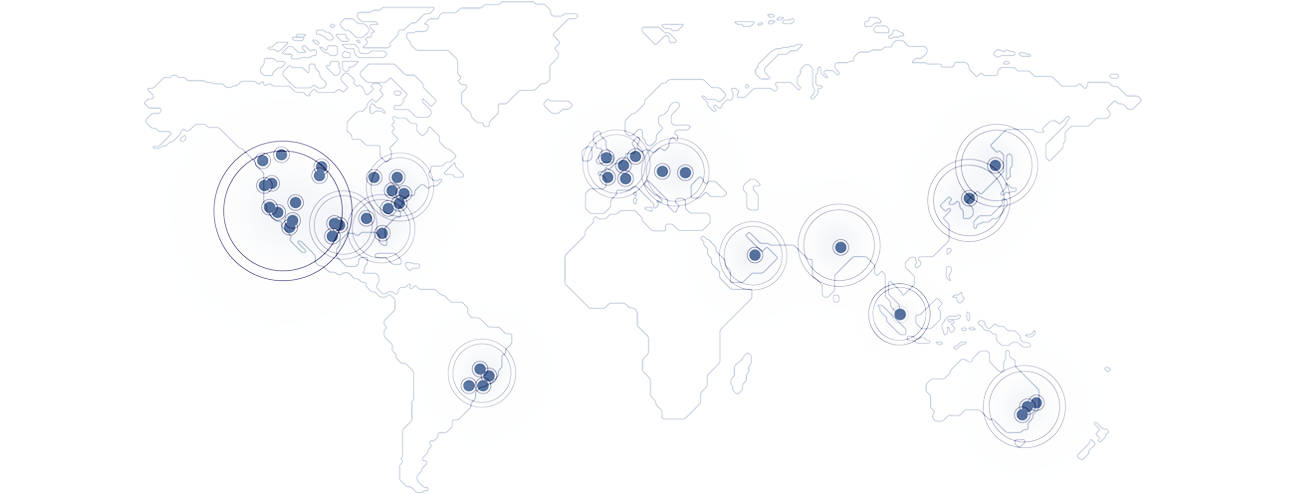

Making the decision about who to hire is that critical component that it is important that leaders not lose sight of amidst all of this change. Here at ZRG, we’re using a data-driven approach to candidate evaluation and driving the right conversations about talent, and we think that it provides a solid foundation that can help firms not only identify the skills they really need to succeed in the future but make the right decisions throughout the hiring process.

Selecting the right leader requires finding someone with the right combination of experience, leadership ability and being the right cultural fit for an organization. Equally important today is recruiting those leaders who are forward-thinking and technologically savvy and can put the right systems in place and inspire the organization to follow them. Despite the concerns for financial services in 2019, overall we remain bullish for 2020.