Industry Spotlight: Aerospace & Defense Govcon Issue 3

In just a few months’ time, the world has changed in highly unanticipated ways. Some have been personally impacted by the COVID crisis in their circle of friends, family, and colleagues. Commercial aerospace had nearly shut down and remains a fraction of its former activity for the foreseeable future. While some industries remain untouched, others like hospitality have been hit even harder. Supply chains that were built on just-in-time inventory have collapsed and are now being rebuilt.

As optimistic as we all tend to be as consultants, we are always attentive to what should be addressed here and now. First, this means understanding what is important to our clients past, present, and future. We act as a sounding board for many of our connections as they guide their career paths in new, uncharted territory, and we are engaged in many searches for new leadership as our clients tackle today’s business problems and strategize for the future.

With that in mind, we look at the skill sets companies will need most in the future, including turnaround experience, supply chain hardening skills, cybersecurity, strategy, business development, and M&A experience. The roles that develop in the future could include more interim executive opportunities to supplement traditional roles as companies address near-term problems while planning for the long term.

In this issue of the A&D and GovCon Industry Spotlight, our global industry leaders share their observations of how subsectors within the industry are operating during this unprecedented time and offer a viewpoint of what’s to come

Commercial and Defense Aerospace:

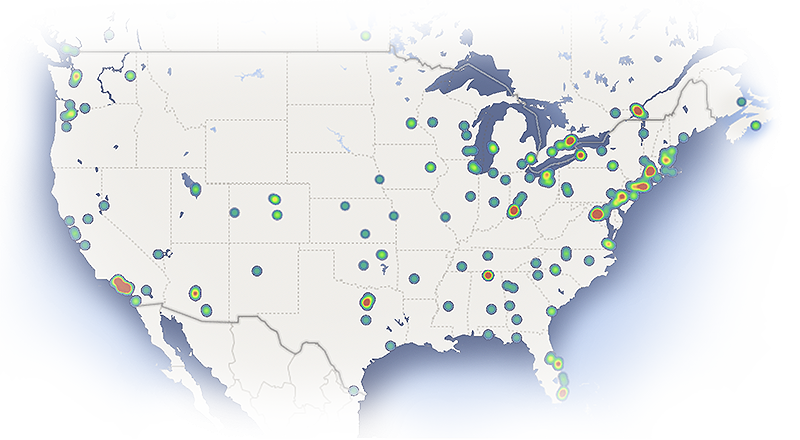

While Defense has been less impacted by the current crisis, shifting government spending priorities will still impact many companies in the sector. We called upon our Research team to highlight areas in North America with high concentrations of Aerospace & Defense employees. It will be interesting to see how the immediate downturn in commercial activity impacts these geographies. Notably, many of the areas with the highest concentrations of employees have also been hard hit by COVID. As companies look to "re-shore" their supply chains, only time will tell if other parts of the country gain an advantage.

With global tensions remaining high, the Defense sector seems poised for near-term growth. In addition, if there is further economic stimulus, the sector is well poised to provide shovel-ready opportunities. The US Navy has aggressive plans to reposition their fleet with a great emphasis on more nimble frigates. The US Marine Corps is also seeking funding to develop equipment and technology to support amphibious action in the future. The build-out of the US Space Force is moving full steam ahead, but they may be impacted by greater financial instability affecting commercial satellite companies where there are public/private partnerships. For entities supporting the build-out of the Space Force, however, there may be opportunities to pick up highly technical talent from commercial satellite companies that have fallen on hard times.

Within commercial aerospace, significant layoffs have already begun and seem likely to increase as furloughs become permanent. This will make available highly skilled pools of labor that could be solid resources for other highly regulated industries less impacted by the COVID crisis. We believe the automotive industry may be well positioned for growth in FY21. Consumers are feeling safer in their cars, and the automotive manufacturing industry may see future government bailouts. Simply put, aerospace talent will likely be more open to opportunities in which they can use their specialized skills in new and unique ways, within industries that they perceive as having greater near-term stability.

US AEROSPACE & DEFENSE EMPLOYEE POPULATIONS

GovCon:

The COVID crisis has accelerated the need for government agencies to improve their cybersecurity and to develop the capacity for working from home where possible. The companies that can help solve these problems from a technology and security standpoint may be well-positioned for future growth. Near-term, funding priorities are drifting away from DHS for the first time in years, and HHS, NIH, and other agencies directly supporting the COVID response may be poised for growth. Artificial Intelligence initiatives continue to significantly expand across all government agencies. Recently introduced legislation, “The National Artificial Intelligence Initiative Act,” would provide $6.5 billion over the next five years to increase funding for AI research & development, education, and standards development. According to the National Security Commission on Artificial Intelligence, government-wide funding on AI and related machine learning R&D is likely to double for FY21 and again in FY22 as government agencies explore opportunities to do more with less. Companies with unique and compelling AI/ML products and services will want to focus on building strong leadership teams and optimizing business development efforts to maximize market visibility and get ahead of these opportunities.

Aviation:

General Aviation

Industry contacts report that private airports, and private terminals at larger airports, have been busier than ever all over the country. In addition, industry sources tell us that piston aircraft fuel sales and corresponding hours flown have bounced back quickly and high-quality used piston aircraft are hard to find. Fractional ownership and charter companies focusing on executive and high net worth travel markets are experiencing substantial improvement as individuals and companies invest in these alternatives to commercial travel.

Unmanned Aircraft and Urban Air Mobility

The drone industry continues to mature and even thrive during the pandemic. Everything from home delivery to crop and infrastructure inspection applications and a variety of DOD programs are in development and/or fully operational. In addition, US-based drone manufacturers are benefitting from trade tensions with China.

Urban Air Mobility initiatives continue to move forward, with dozens of companies looking to carve out niches in what will ultimately be an enormous market. A ZRG client working in the regulatory space shared that several significant companies have asked for their help with airspace integration, aircraft certification, and public relations efforts. The next couple of decades will be incredibly exciting, and the pandemic hasn’t caused any significant slowdown in new (but sure to become long-term) investments in the industry.

UK & EU ADI:

With the UK set to leave the EU without a deal, vulnerabilities and short-term disruption of manufacturing & supply chains is soon to follow. In addition, increased challenges from competitors such as Russia and China have arisen.

However, all should not be gloomy, as the UK possesses the second-largest A&D industry in terms of revenue, exports circa 78 billion T/O GBP, and employs nearly 380,000 highly skilled people. Having stepped away from OEM aerospace manufacturing, the UK is a hotbed for innovation and bleeding-edge technologies that contribute circa 44 billion in exports. Examples of UK strength in innovation are composite manufacturing, systems and device markets, and cybersecurity/data & analytics.

COVID-19 is, of course, the current and very real obstacle at hand. It is clear to all this will affect UK and EU airlines and airports heavily, with casualties such as Flybe, Thomas Cook, and the majors all mothballing aircraft and scrapping older airframes. In the EU overall, the outlook is rather similar to that of the UK; the commercial aviation sector will take years to recover, and naturally, the downstream effects will be painful.

The EU Defense & Intelligence sector, however, should thrive and grow further as national and international security threats remain numerous and ever-present. Additionally, the UK contributes greatly to the ever-burgeoning EU space industry, made up of satellite companies, defense spending, and components for space vehicles. Further, driven by the US rhetoric for more participation from EU states, EU nations are requested to spend more Euros with NATO and to take a larger responsibility with new threats from radicalized EU nationals and Russian power play in the Balkans.

The EU space industry is a positive growth area, with projects such as Galileo, ClearSpace, and Copernicus driving innovation amongst the member countries. Moving forward, the pressing issue will be the outward migration of highly skilled workers and engineers from ADI companies to other complementary markets, such as medical devices, which could create a skills shortfall over the long term. As of 2019, the EU ADI market was worth an estimated EUR246 billion, with 870,000 highly skilled employees in EU. The 2020 outlook, of course, may descend from these figures.

In essence, the UK and EU outlook can be summarized as Defense looking positive while Aerospace and travel present as a large negative.

Final Insights

ZRG’s ADI team is at the forefront of this innovative but volatile market segment, and we feel the pulse of the industry even in times of great transformation. We remain optimistic about growth prospects for companies and opportunities for talent – A&D will always require the top minds to promote innovation into this new decade. On top of that, the industry will demand transformational and change leadership to keep us moving forward, safely, through 2020 and beyond!