Consumer Health & Wellness, Deeper Into the Pandemic

8 Min. Read

Prior to the onset of the COVID-19 pandemic, the Consumer Health and Wellness industry was focused mainly on improving the quality and possible length of people’s lives. We were seeing rapid developments across medicine, hygienic habits, food quality, and a broadening range of health and wellness products that were poised to increase life expectancy, which has indeed been rising across the globe. These trends had been accelerating since 2000 without any real sign of an organic slowdown when the SARS-CoV-2 virus arose, giving a sinister gloss to Ralph Waldo Emerson’s 1860 observation that “the first wealth is health.” We spoke with industry leaders to assess the current state of the sector.

Growth and Technology

The sector has grown through an increasing reliance on technological innovation. This innovation is not limited to product innovation but also has ramifications for supply chain management and brand awareness. Consumers have become reliant on technology—e.g., smart watches/wearable tech or smartphone apps—to increase disciplined choice-making in pursuit of a healthier lifestyle.

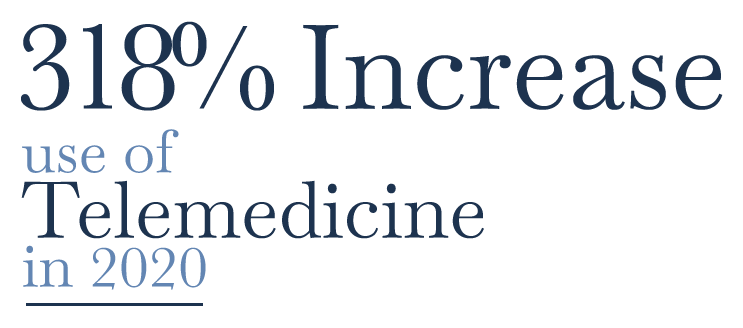

It is not surprising that consumers would seek to optimize their health and be concerned with wellness when facing a generational threat in the form of a pandemic. We have witnessed growth in telemedicine—especially as related to mental health and wellness—and an explosion in home fitness spending. Software developers are keeping pace with hardware innovators in allowing us unprecedented visibility into the state of our health.

Mental Health as Personal Wellness

The COVID-19 crisis has taken an inescapable toll on both physical and mental health and wellbeing. It has, however, also increased attention to an otherwise overlooked segment of personal health and wellbeing. Mental health needs are often stigmatized and segmented out of the overall wellness journey, yet 20% of all US adults experience some form of mental illness. Mental health and wellbeing apps have stepped into this gap and are estimated to be a $47.7 billion market in 2021. The number of apps offered in the main app marketplaces saw a nearly 72% increase from 2015 through 2020.

The link between mental and physical wellbeing is well established: people with depression have a 40% higher chance of developing heart and metabolic diseases than the general population. Technological innovation is helping to drive the adoption of better mental health habits as well, with behavioral health startups collecting $588 million in funding through the first half of 2020. This area of personal health seems like it will be staying virtual even after the pandemic is under control, with 62% of consumers indicating a preference for virtual mental health care vs. in-person care.

You Are What You Eat

This could be the beginning of a new era. All these developments combined will have a significant impact on healthcare costs, decisions on where companies allocate budget resources, structure of the competitive landscape, technology investment, recruitment, and development and retention of talent, among other considerations. These evolving market dynamics are fueled by technology improvements and driven by the more educated choices consumers of all ages are making across products that impact their lives in the short and long term. As a product sector, Consumer Health & Wellness has increased home availability, personalization, categorization, and overall scope of choice. It enables consumers to a more purposeful life within a wider range of lifestyle avenues.

The Consumer Health & Wellness sector has evolved from OTC brands into our daily lives. It has substantially gained breadth and depth. We have seen a very large introduction of new categories and new brands, many of which are gradually migrating from niche to necessity status. The beverage aisle has become highly fragmented, forcing many retailers to allocate multiple aisles to ensure product availability and diversity. Supplements are a staple: vitamins, minerals, and protein intake are on the rise. Bio and organic-based foods are increasingly gaining market share. Diets are “en vogue.” More health and environmentally conscious consumers are adopting a vegan or vegetarian lifestyle, and many are following Keto or Paleo diets as their preferred eating habit. The pandemic has increased demand for subscription-based grocery and meal kit services. Imperfect Foods saw a 229% increase in its business through 2020, and consumers increased their purchase of prepared meals by nearly 67% from 2019 to 2020.

Consumers are conscious of their alcoholic beverage intake. Combustible tobacco consumption is in constant decline. The use of cannabidiol (CBD) products has steadily increased every year since 2014 as consumers better understand its uses and benefits. Prior to the pandemic, the number of fitness centers was steadily increasing. Once the pandemic hit in earnest, that energy transferred to home fitness, with revenue in that sector shooting to $2.3 billion from March through October of 2020. Consumers purchased 135% more treadmills and 300% more stationary bikes in 2020 compared to 2019.

Medicine, Telemedicine, and Fitness Tracking

We are aware of skin exposure to sun and sensitive to the importance of regular dental and visual doctor visits. Our watches measure every second of our day, providing persistent feedback and data on activity and fitness levels. As of January 2020, 21% of all Americans were using fitness tracking watches or devices, and people earning $75,000 or more outpaced the overall population by an additional 10%.

In parallel, traditional medicine continues to progress and has become a more accepted option for many consumers. Diagnostics have become more accurate, and OTC drugs are available at more varied price ranges, even in convenience stores. Consumers have adopted a proactive approach to life as they want to look and feel good in addition to being healthy.

Industry leaders indicate a growing consumer preference for natural solutions and personalization in place of pharmaceutical intervention. AI is gradually permeating the industry and turning customization into a reality. Consumers want a relationship, not a transaction with Consumer Health & Wellness companies. Alibaba, for example, has set up a 24/7 hotline to provide consumer advice ranging from “better for you” foods to complete personalized wellness routines.

In our market discussions, experts shared that we have come a long way, but there are significant opportunities yet to be addressed. There are many startups, but regulation can be a hindrance. Bigger players must become nimbler, learn faster, and be even more consumer centric. The market remains highly fragmented, creating opportunities for M&A. Industry will continue to grow, new solutions will emerge, more categories will play a greater role in the total industry development, and consumers will become more loyal as brands are built and bonds created. The market will become more specialized, driven by consumers’ rapidly evolving needs.

A Human Capital Perspective

All our contributors agree that the market dynamics have dramatically changed the competencies required to be competitive and successful in this booming industry. Today’s leaders must be able to envision and anticipate a future to be created; there are no past examples. Innovation is critical, and diversity of thought is a must. Inquisitiveness, creativity, and learning agility are all vital skills. Successful leaders need to be able to translate data and technology into innovative products with an advanced ability to execute strategy. Top talent is fast-acting, adaptive, and nimble. Leaders must be able to think holistically, customize products and offers, and improve the consumer experience to differentiate brands and create consumer bonds. Successful leaders will adopt the concept of everyday excellence. In our experience, high performers are open to companies that are credible, aim long-term, and have a clear purpose to improve lives.

Candidates in the sector are increasingly more discerning in selecting their next role. Cultural fit, affinity with the product, and alignment with the company’s purpose are all fundamental to a successful career transition at this point. Companies that modernize their approach to work will find themselves better positioned to recruit forward-thinking leaders. The pandemic has demonstrated the viability of working from home for many, which in turn has changed thinking about relocation. This change is not limited to any single category of age or seniority; telework is making every company a global company.

Employees are also becoming more selective in terms of total compensation packages. It may not be sufficient to offer top dollar without also having generous maternity or medical leave policies. US-based companies are now having to compete one-on-one for talent with established European companies and their more generous paid leave packages. This may require US-based companies to adopt a more European outlook on employee dedication. Flexibility in location and reporting hours are becoming top priorities for desirable candidates in the sector.

As we begin to see the end of pandemic-related restrictions on travel and movement, larger consumer companies are reassessing the need for physical office space. Some are redesigning existing office space to be more accommodating for large meetings by reducing the number of individual offices. If employees only need to report to the same physical building for face-to-face meetings, there is not as great a need for each employee to have a personal workspace within that building. A few organizations are moving to divest from office real estate altogether and are choosing instead to focus on robust work-from-home provisions. Full remote work does present unique challenges to onboarding new employees, but it is generally looked upon as a less expensive alternative to maintaining a unified physical address.

The CEO and CHRO will play a key role driving change and designing the path forward. Company ownership and size are also determining factors in how an organization will structure their new work requirements. This is a big opportunity to reinvent how we work. Showing courage and leadership can make a difference.