2024 MedTech Outlook

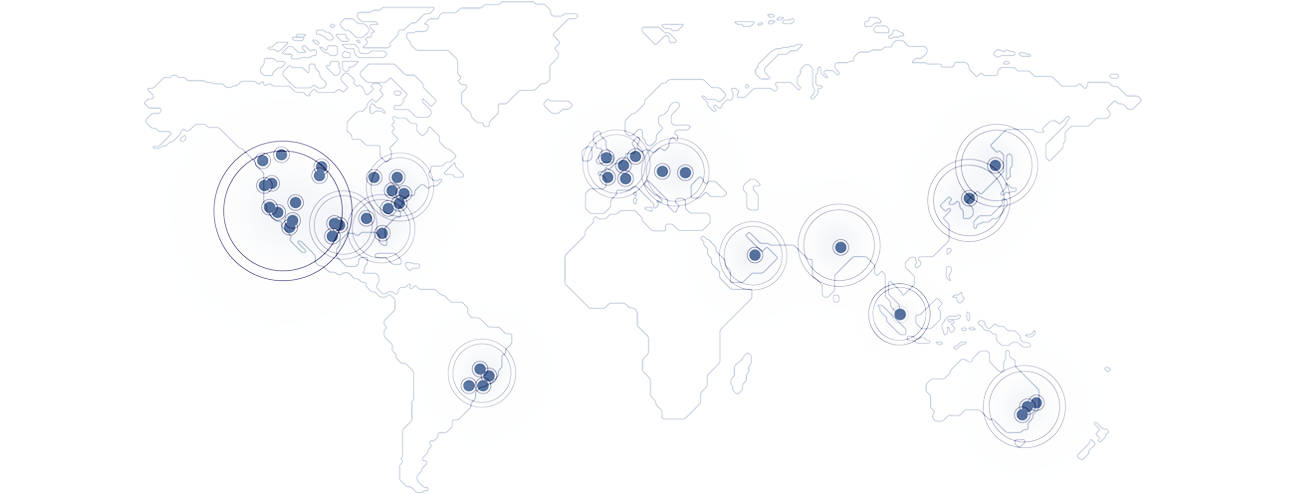

As co-leaders of ZRG’s MedTech practice, we have a privileged view from both sides of the Atlantic. Our teams are on the ground throughout the UK, EU, and North America. We’ve spoken with some of the leaders in our network to assess reactions to existing trends and to work through the 2024 playbook. Business rarely rebounds as quickly as we would like, and whether 2024 is a rapid rebound or a slower turnaround remains to be seen as the year plays out. Even so, we see clear signs that economic forces are moving in a positive direction.

Challenging Turnaround

We all wanted 2023 to be a year of rebound, but what we got was more complicated. While the medical devices/medtech sector had been plagued by supply chain problems, staffing shortages, and a predicted recession throughout 2022, most of those issues had greatly improved, if not entirely resolved, by the end of 2023. We don’t expect a regression from 2023 in staffing numbers, although supply chain disruptions continue to cost CEOs sleep.

2023 was a bit protected and cautious, caught between clinical and regulatory fatigue and investors awaiting commercial results. Growth was historically lower than previous years. We believe the market will continue to be cautious in early months of 2024 but begin to gain traction as the rate of innovation has greatly accelerated as we continue to move into leading edge technologies chasing the billion-dollar markets.

Ivan Tornos, President & CEO of Zimmer Biomet (NYSE: ZBH), shared his concerns around geopolitical instability and macroeconomic factors with us. High interest rates dogged the pace of mergers & acquisitions through much of the year. Ongoing conflicts across the globe led not only to supply chain disruptions but to disruptions in the lives of workers. We heard echoes of his concerns with many of the executives we spoke with and share them as well.

Following the Money

Some MedTech companies have already returned to billion-dollar investment deals. Boston Scientific picked up Axonics and their sacral neuromodulation systems for overactive bladder and fecal incontinence at a cost of $3.7B. Coloplast bought Kerecis for $1.2B, consolidating their position in wound care. We are watching numerous others sign early deals for AI and software development companies.

We believe that investment will continue to support strong technologies and enabling technologies within MedTech. Companies continue to pitch investors with a clear data driven mission, but they will need to have experienced leadership to execute a path to revenue. This leadership will sometimes reach across tech industries.

We see private equity in particular continuing to focus on 510(k)s as a guidepost. This segment has an appetite to invest in technologies and entities to bring to public markets or acquisitions. Further, suppressed money that has been sitting on the sidelines and needs to be spent will lead a period of great growth in our industry rolling into 2025.

Innovation and Regulation

Hospitals continue to be focused on innovating in value-based care. FDA guidance continues to be more robust, driven and measured not only on the collection of data but the insights that can be monetized. Data-based innovations will continue to drive companies toward service models that new technology to propel profits through the utilization of AI. The focus shifts from selling one-off products, to providing integrated service solutions that generate recurring revenue opportunities.

Regulatory bodies will want to see proof of value-based care, improved outcomes, cost savings, and time, and companies are increasingly in search of critical roles with strategic skill set in the use of digital platforms and AI technology to optimize patient, clinician, and caregiver interaction.

In line with these predictions, Tornos told us that he has set goals to “continue to change the standard of care in orthopedics [by] making surgeries shorter, outcomes safer and more predictable, reducing cost, and improving the overall experience.” We feel their plans to move from a legacy product to a best-in-class MedTech firm—in his words “the boldest MedTech company on Earth” —are well timed, and 2024 could prove a pivotal year.

Politics and Other Outside Forces

At the end of 2023, news cycles were filled with the Israel-Hamas War, the Russian invasion of Ukraine—which is nearly 2 years old now—and the 2024 United States presidential election. Each of these is a factor outside the control of any MedTech CEO. Nevertheless, we cannot ignore their impact on the global economy.

Joe Woody, CEO of Avanos (NYSE: AVNS), shared that “Coming into 2023, we anticipated some continued supply chain headwinds and pockets of product availability challenges. Fortunately, demand for our products has remained strong and supply chain disruptions have lessened, as expected, but we continue to experience some ongoing product supply challenges and the effects of inflation throughout our supply chain.” Woody, however, sees 2024 as a year full of potential, noting that “Having the right talent in place is and will continue to be critical to achieving our transformation goals. Skilled and adaptable team members serve as the catalysts for innovation, strategic decision-making, and effective implementation, all of which will drive Avanos toward successful and sustainable change.”

We expect improved performance from global capital markets coupled with clarity from the Geopolitical landscape will underpin a renewed sense of optimism from our MedTech client base. We believe this global ecosystem will benefit from EU/US elections giving a clear direction from 2024/25 through the next political cycle being just one example of a micro influence expected to positively effect performance and results.

Talent Trends for 2024

We believe that the dynamics on both sides of the Atlantic will benefit significantly from the easing of inflationary pressures and renewed optimism in growth and capital market confidence. 2024 promises to be cautiously optimistic in outlook. With a growing sense that clarity and stability, coupled with operational transformation should set the sector up for success in mid to long term. Irrespective of winners an losers, final election results will close down the anxious uncertainty in the political sphere. Public markets will start showing signs of recovery in the summer and then escalate in Q4.

Talent has been reluctant to relocate immediately post pandemic, but as more and more clients focus on getting back to the office and senior leadership increasingly highly visible in headquarters. We expect top talent will be much more flexible and open to relocating for the right roles with exciting companies in 2024.

Leadership has begun to shift to the PE market, as we have seen many divestures within the large MedTech companies which then, as smaller enterprises, rely on PE investing. That PE market build will continue to attract top talent and talent retention will become a bigger factor. Top talent will continue to be attracted to action-oriented activities where they can execute and scale.

In summary, 2024 will be one of growth and execution from product to solution focus and what the industry has learned from in recent years. We are optimistic as career opportunities lie at the intersection of market demand, logical growth, investor commitment, and leadership.